Modernizing the SIU to Combat Healthcare FWA

For more than a decade, the SIU has relied on reactive business models. But with the rapid gains in advanced technology platforms, health plans are beginning to embrace more adaptive methods, working smarter to deliver tangible results.

Highlights

Factors at play

- Approximately 3-10% of all US healthcare spend is attributed to fraud, waste, and abuse.

- The SIU is being tasked with delivering tangible results and “holding their own” as a business unit.

Current Climate

- The legacy systems in place in many SIUs keep the function siloed and reactive.

- Misunderstanding of artificial intelligence by buyers / investigators, vendors overstating capabilities of advanced technology.

- Complex provider networks create difficulties managing leads and cases.

- Difficult to connect overpayment avoidance to value.

Looking Ahead

- Organizations that fully integrate FWA and payment integrity are shown to deliver impressive ROI. This could be a framework that more payers seek to adopt. Leaders should consider thinking beyond structural integration to SIU and PI systems, data and insight generation and resolution.

- Health plan leaders are becoming savvier about advanced technology capabilities so that they can better understand technology vendor claims.

- Adaptive technologies will be an added FWA tool set to make up a greater percentage of the SIU’s technology stack.

- Expertise in healthcare FWA will be a differentiator to vendor-payer relationships given the unique nature and complexity of healthcare-specific schemes.

Foretold disruptions to payer operations are squarely upon us. The pandemic has served as a catalyst for many industries, especially healthcare. As health plans have found themselves needing to make rapid changes to their business models, the accelerated disruption has exposed gaps in technology and process. Anti-fraud, waste and abuse teams remained insulated from this quick-paced transformation witnessed in other health plan departments – but industry experts predict this won’t last much longer.

For much of 2020 and into 2021, it was business as usual for the SIU while everyone was waiting for the effects of COVID to shake out. There was a sense that bad actors would take advantage of legacy business models, but those relying exclusively on legacy solutions had to take a wait-and see approach.

But now that trend has shifted. The sense that FWA approaches should be more proactive and less manual is being felt by the SIU.

The National Academy of Medicine (NAM) agrees. They advise that “as virtual care becomes a permanent feature of care delivery, payers will need to equip themselves to evaluate the risk for fraud and abuse.”

Kyle Cheek, PhD, offers his unique perspective informed by a career as a healthcare SIU leader and Clinical Associate Professor at the University of Illinois-Chicago. He also serves as the Director of the Center for Applied Analytics. Here, Dr. Cheek gives a look at reactive vs. adaptive business models in the SIU and how market factors require a new way of doing things.

Reactive Business Models in the SIU

Healthcare fraud, waste and abuse investigators are by necessity a risk-averse group. Rules-based technology supports a static and highly-repeatable process. The result? A static business approach that has created a norm for remedial strategies being acceptable in the SIU, which in turn makes changes difficult. Rules are, by their very nature, largely reactive and only able to capture known schemes. The best rules-based systems will offer analytics or low-level applications of artificial intelligence to try and predict possible FWA.

But the crystal ball approach isn’t working anymore. “It’s no coincidence that as I go back into SIUs and meet with their dedicated analytics staff, they are typically new graduates with data science skill sets. SIUs have realized they need an infusion of new ideas to generate real value and remain relevant as their businesses evolve around them,” says Dr. Cheek.

Compliance with regulatory agencies is top of mind for the SIU, and that pressure may perpetuate the use of technologies that produce highly-repeatable results. When audits are conducted, payers need to show how they will answer specific schemes. This focus, in turn, may lead to an over-reliance on rules-based solutions. But Dr. Cheek cautions this is a short-sighted strategy, particularly for leaders who are looking to show big gains by challenging the SIU to hold their own.

Reactive Business Models No Longer Deliver Optimal Value

The stream of recoverable losses that can be generated from pre-defined detection models is running dry as schemes sophisticate, says Dr. Cheek. “It’s becoming more difficult for rules-based systems to identify fraud, waste, and abuse and show year-over-year return because fraudsters are becoming more adept at creating claim patterns that look more generic.”

This gap leaves health plans more exposed than ever. Rules-based systems can only catch highly aberrant behavior.

The typical process a rules-based system supports has limited reach:

- Run multiple queries

- Combine queries to see the bigger picture

- Look at top of list

- Take action on X%

Interestingly, whereas this approach was once “safe,” it is quickly becoming riskier as the SIU’s efforts are no longer fully quantified by serving as a sentinel, notes Dr. Cheek. Now, payers need to show their stakeholders how they are proactively reducing FWA and preventing leakage. Especially with virtual care models and other disruptions. Investigators are expected to deliver results by showing increased avoidance and recoveries.

Where can the SIU find value today? According to Dr. Cheek, and the health plans he consults, it’s in the unknown.

Adaptive Business Models Hold Promise for the SIU

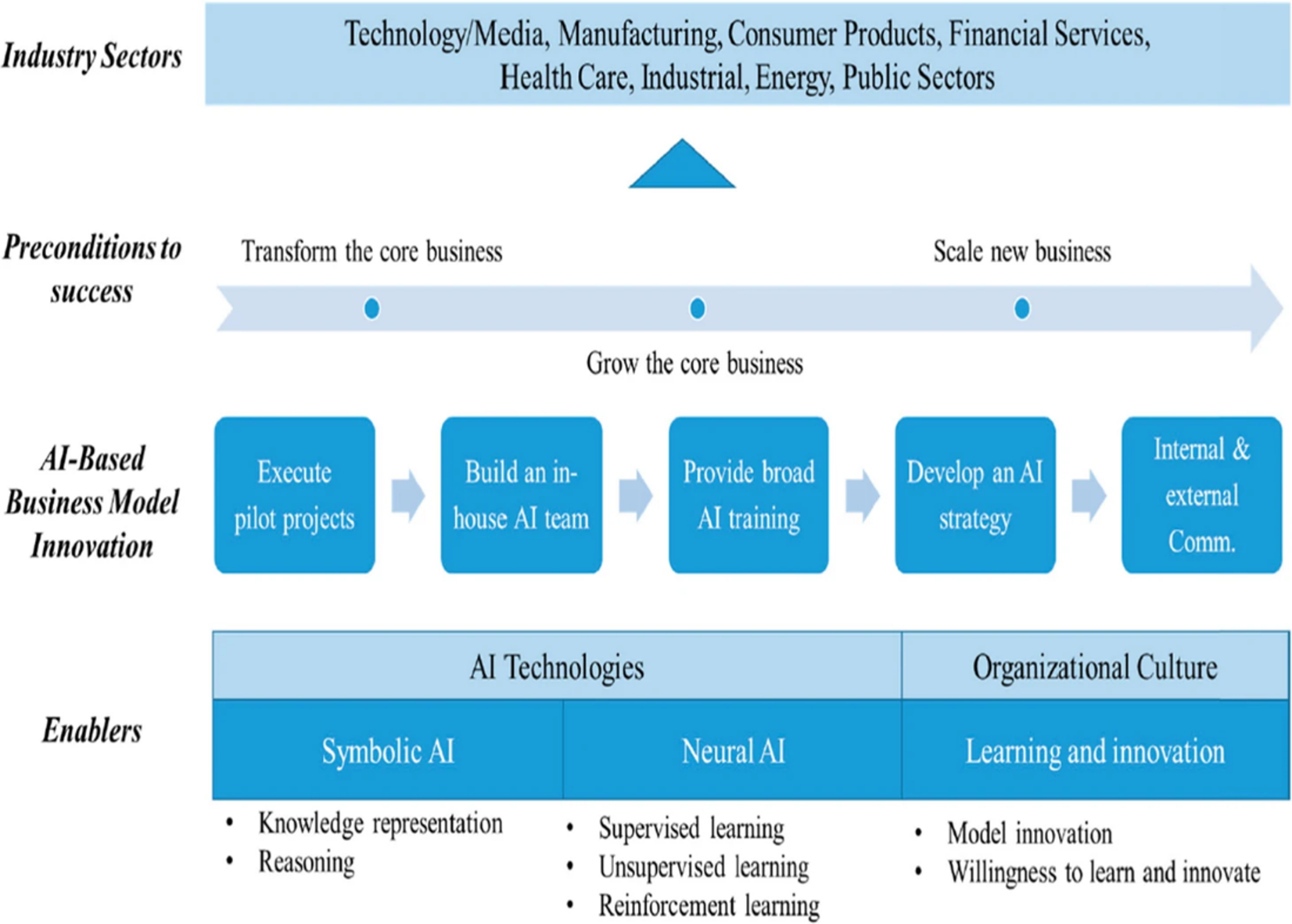

Adaptive methods use “smart” technologies that surface actionable findings which can deliver greater value to payer business units that are responsible for detecting and reducing FWA. Dr. Cheek advises SIUs to consider how more sophisticated detection methods can help payers surface equally sophisticated anomalies.

Adaptive tools and business models offer value by making processes more efficient, reducing costs, and minimizing overlap between the SIU and payment integrity. Benefits include:

-

- More efficient claims selection and validation processes

- Realizing administrative and operational cost savings

- Reducing cost and provider abrasion by reducing false positives

- Less overlap and greater insights offered through bi-directional SIU and payment integrity integration

But advanced technology platforms cannot replace the subject matter expertise that knowledgeable resources bring to the table. Though this is a common concern that may cause SIUs to dig in further on legacy solutions. What they can do is help anti-FWA teams work smarter and more efficiently with limited resources.

With new directives to show value, payers are realizing that legacy tools are static, thus limiting overall analytic capability. With the rapid evolution of advanced technology, systems can begin telling us more about the unknown.

How can your SIU embrace adaptive business models?

On-demand: Watch a free educational webinar featuring Blue Cross of Idaho to learn how they are preparing for the future of FWA.

Advanced Technology Platforms Offer Adaptive Frameworks for SIU

Legacy tools in place in many SIUs keep these skilled resources structurally separated from overall payment accuracy efforts. This disconnect stifles innovation, fails to acknowledge the spectrum of waste and abuse that far outweighs fraud, and limits the value story that this function can tell.

Pareo Fraud was developed with the understanding that payers were ready for an FWA solution that could offer advanced technology in a familiar framework, one that integrates with payment integrity to translate the SIU’s work into value.

“An adaptive business initiates change; an agile business reacts to it.” Forbes

A Cultural Shift is Key

The shift currently occurring in the SIU requires seasoned investigators to embrace a new way of doing things. The change from predictable to adaptive means that they will need to understand new objectives, new frameworks, and how to work effectively with data science colleagues that are joining their teams. Investigators know that the key to reducing fraud, waste, and abuse is in changing provider behavior. Working across payment accuracy teams and thoughtfully leveraging advanced technology will help the SIU shift focus.

Creating a culture of innovation and encouraging a willingness to learn are crucial to adaptive business models.

Investigators also will need reassurances that advanced technologies are not being put in place to replace them, but rather to enhance their expert decision-making capabilities.

“Combining human intelligence and AI into augmented intelligence focuses on a supportive or assistive role for the algorithms, emphasizing that these technologies are designed to enhance human processing, cognition, and work, rather than replace it.” (Source)<h/2>

SIU Expertise More Valuable than Ever

The evolution of the SIU matches the one currently occurring in payment integrity departments. Health plans have a unique opportunity to innovate and show value, centralizing data to work in an adaptive business model.

And, although data science and other advanced technology approaches are increasingly present on specialized investigation teams, Dr. Cheek knows better than anyone that an actual understanding of healthcare fraud, waste and abuse cannot be easily replaced. “It has never been more important to marry expertise with innovation – the two cannot be untethered.”

Health plans can make the most of their FWA expertise, find value in the unknown, and become more proactive with the adaptive capabilities in modern technology platforms like Pareo.

Now’s the time for total payment integrity

See the ClarisHealth 360-degree solution for total payment integrity in action.