Power of Payment Integrity Conference Reveals 5 Strategic Insights

Payment integrity leaders from the country’s top health plans gathered at the Power of Payment Integrity Conference to find strength in community, share innovative strategies, and discuss key themes that are shaping the future of the industry.

After the last POP Conference, we noted the “growing sense that payment integrity is at an inflection point.” We didn’t know then just how true that statement would be. In just one short year, pressure has been turned up on …

- Administrative costs, medical loss ratios and associated client and public scrutiny

- Government program cuts

- Discretionary spending on investments in, well, everything

And because no one goes to school for payment integrity, the Power of Payment Integrity Conference 2025 provided a prime opportunity to collaborate on these challenges.

“Escalating regulations put pressure on Payment Integrity to be the one remaining lever in managing claims cost.”

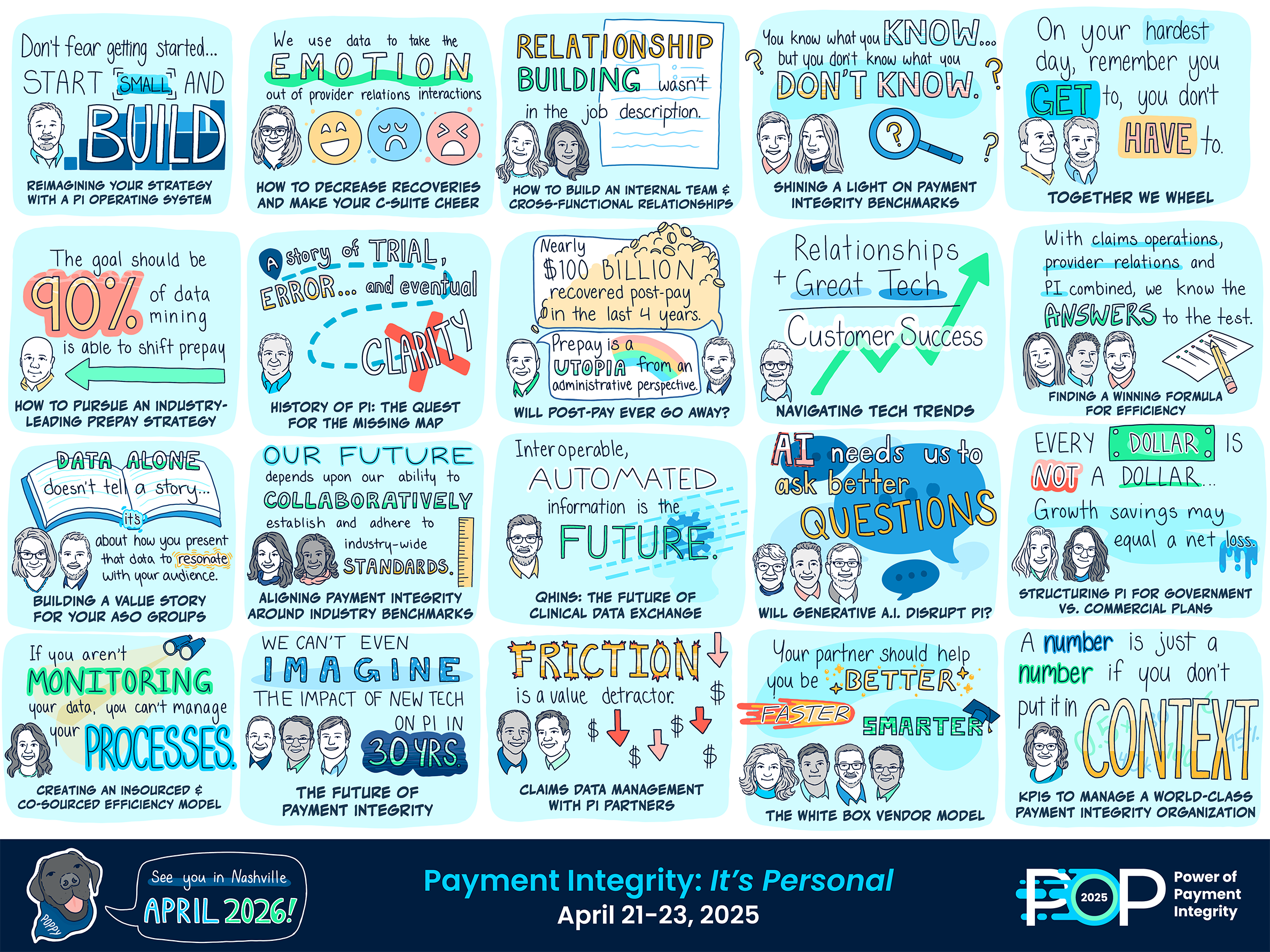

For two full days, industry leaders taught master classes on what is and isn’t working and how they’re thinking about the future. Across 25 sessions, a few themes emerged from the Payment Integrity experts on stage – and the audience engagement they inspired: A.I. value, industry benchmarking, prepay progress, right-sourcing strategies, and data challenges.

Let’s explore their five biggest insights from these themes.

A.I.: Show Me the Value

Hardly a session passed without A.I. being a topic of discussion. Especially in light of increasing adoption across payers for complex audits, fraud detection, appeals and disputes processing, and UM in clinical specialties. There’s a lot of noise in the corporate world recently about “A.I.-first”. But that’s simply not the case in payment integrity shops where trust and defensibility is paramount. It’s still a human-first strategy. And one that’s aiming for optimal value without compromises:

- Speed AND accuracy

- Automation AND human insight

- Efficiency AND sustainable jobs

The promise and potential of newer applications of A.I. are significant. But where’s the proof? Despite the chatter, we’re still light on reliable ROI results from real payment integrity use cases.

“Do you have a vendor that’s not talking about A.I.? Everybody’s innovative.”

You can mitigate this concern and keep pace with technological advancements. Best advice: develop a phased A.I. roadmap with high-potential ROI pilot use cases, perform time studies to validate efficiency gains, ensure A.I. applications are integrated within a larger payment integrity technology framework, and weigh build vs. buy options based on internal capabilities and IP preservation considerations.

PI Benchmarks: Now’s the Time

The industry has long agreed on the need for payment integrity benchmarks that go beyond catch-all CMS-issued savings targets. Benchmarks help identify blind spots and opportunities for improvement in payment integrity programs. They also create trust from health plan finance leaders.

“I never met an executive who stopped asking questions after I gave them a number.”

However, though many organizations have tried, inconsistent definitions, data, and program maturity keep holding us back. But we have to start somewhere.

ClarisHealth released an initial slate of high-level metrics and statistics compiled from client data – spanning LOBs, maturity levels, programs and vendors – and industry sources. These include estimates that payment integrity savings represent 5-7% of medical spend, internal recovery rates of 26.7%, and prepay cost avoidance of nearly 62%. One note: there is significant variability in these metrics across different health plans.

At the same time, a group of payment integrity leaders representing health plans and vendors also has started work on a benchmarking initiative. They started by agreeing upon key definitions and metrics. Participating health plans are now calculating their own results to validate the approach.

Establishing national standards will require industry-wide commitment. Health plans should establish their own baselines and work collaboratively to develop more standardized benchmarking approaches. Including capturing the impact of cost avoidance and prevention efforts, not just recoveries, in order to fully demonstrate the value of payment integrity programs.

Shifting Prepay: Are We There Yet?

The industry is still prioritizing “shifting left” to prevent overpayments before they happen. This shift was validated by KLAS research, and the goal is to address both provider abrasion and potentially $47 billion in administrative costs. In that shift, standardized metrics and collaboration between payers and providers are seen as critical to improving payment integrity.

This effort is progressing on several fronts: using post-pay insights to move concepts upstream to secondary edits, taking advantage of newer A.I.-augmented technologies to maximize internal team efficiency, and incorporating focused provider education into the payment integrity function.

The stats coming out of this effort are impressive:

- At least 90% of data mining audit savings can be shifted prepay.

- An enterprise PI approach that incorporates a provider education program can yield $5 PMPY savings on average.

“When we have good provider collaboration, we see a 30-40% decrease in audit findings in 6 months.”

Want to move faster on prepay goals? Continue to monitor and refine A.I./machine learning models, especially as code sets change. Evaluate opportunities to bulk approve certain concepts with low dispute rates. And maintain post-pay backstops when implementing new prepay concepts. After all, post-pay audits still hold a position of significant value in payment integrity programs; they generated more than $100 billion in recoveries in the last four years.

Right-Sourcing: Better Costs, More Control

Rising administrative costs prompt intensive questioning from leadership: How much are you returning for every dollar you spend? Add in prepay programs and self-funded clients, and the question gets more critical. Self-funded plans expect prepay fees to translate to fixed issue resolution, not just ongoing contingency fees.

Focusing on insourcing is a natural reaction. But the most sophisticated programs have a bigger picture, longer term strategy: right-sourcing. It’s a multi-pronged approach that leverages technology for a holistic approach to creating program value:

- Transition from a fragmented array of vendors managing audits to an integrated value chain approach across vendors and internal resources.

- Build internal data analytics capabilities.

- Account for the total direct and indirect costs of the program, including vendor fees, disputes and appeals, technology, personnel.

And when you do outsource, prioritize transparency and structure the relationship for innovation. Look for partners with strong tech platforms and teams that can elevate your capabilities. Consider flexible pricing models that align with your goals (e.g., license-based, tiered contingency fees). And evaluate partners on their ability and willingness to provide root cause analysis and drive behavioral changes.

“We don’t need to pay for the same post-pay edits for a lifetime.”

The Data Challenge: Solving the Crux of Payment Integrity

“The crux” is the term mountain climbers coined for the toughest part of a route. The Pease brothers, who gave the inspirational keynote that kicked off POP Conference, faced the crux during their Hawaii Ironman bouts: the lava fields. It’s dark. There are no spectators cheering them on. It got bleak more than once, and in more ways than one.

But here’s the kicker: once you find and solve the crux, success is yours.

Answering the data challenge – who owns it, what insights it reveals, how to get it where it needs to go faster – is “the crux” of payment integrity. It’s the ONE constraint that, when removed, unlocks progress on many fronts.

“Data should work for your Payment Integrity team, not the other way around.”

Need to take advantage of advanced A.I. applications? Understand which concepts to prioritize for prepay? Determine which audit programs your team should take first pass? Make faster pay/pend/deny determinations? Prove the impact of shifting overpayment prevention further upstream? Receive medical records quickly and seamlessly?

Data – standardized, integrated end-to-end, and accessible – is at the root of each of these initiatives.

Complex source systems, overloaded IT teams, and vendor friction complicate the solution. But a flexible data layer that abstracts source system complexity can accelerate payment integrity initiatives and ROI. And there are opportunities to create common data models within organizations to overcome the lack of industry standards, without overtaxing internal IT teams.

This Community is Building the Future of Payment Integrity

Ultimately, we reaffirmed PI leaders are more than capable of leading the disruption needed in the industry. And the past has more than prepared us for the moment at hand.

Those vendor-first strategies? Taught us the value of having greater control over our operation. “Found money” foundations? Showed us how much value payment integrity can bring to the health plan. Manual processes? Created professionals that understand operations inside-and-out.

“Reimagining your payment integrity strategy with a tech-first approach isn’t just about compliance; it’s about building trust and efficiency into every transaction.”

This needed transformation – beyond vendors, beyond recoveries – is a tough task, but there’s strength in numbers. And, despite their unique differences, health plans are united by a common purpose. Leaders from Blues plans and nationals, government payers and commercial, well-established and startup programs alike are driven by their personal impact on reducing the cost and complexity of healthcare.

We are equally committed to continuing to provide a platform for them to do so. In April 2026, the Power of Payment Integrity Conference will once again return to Nashville. It will bring that same environment of payment integrity focus and no sales pressure to the next set of challenges and opportunities the industry brings. Let’s get to work!

Now’s the time for total payment integrity

See the ClarisHealth 360-degree solution for total payment integrity in action.