Payment Integrity Leaders Reveal What Will Move the Industry Forward

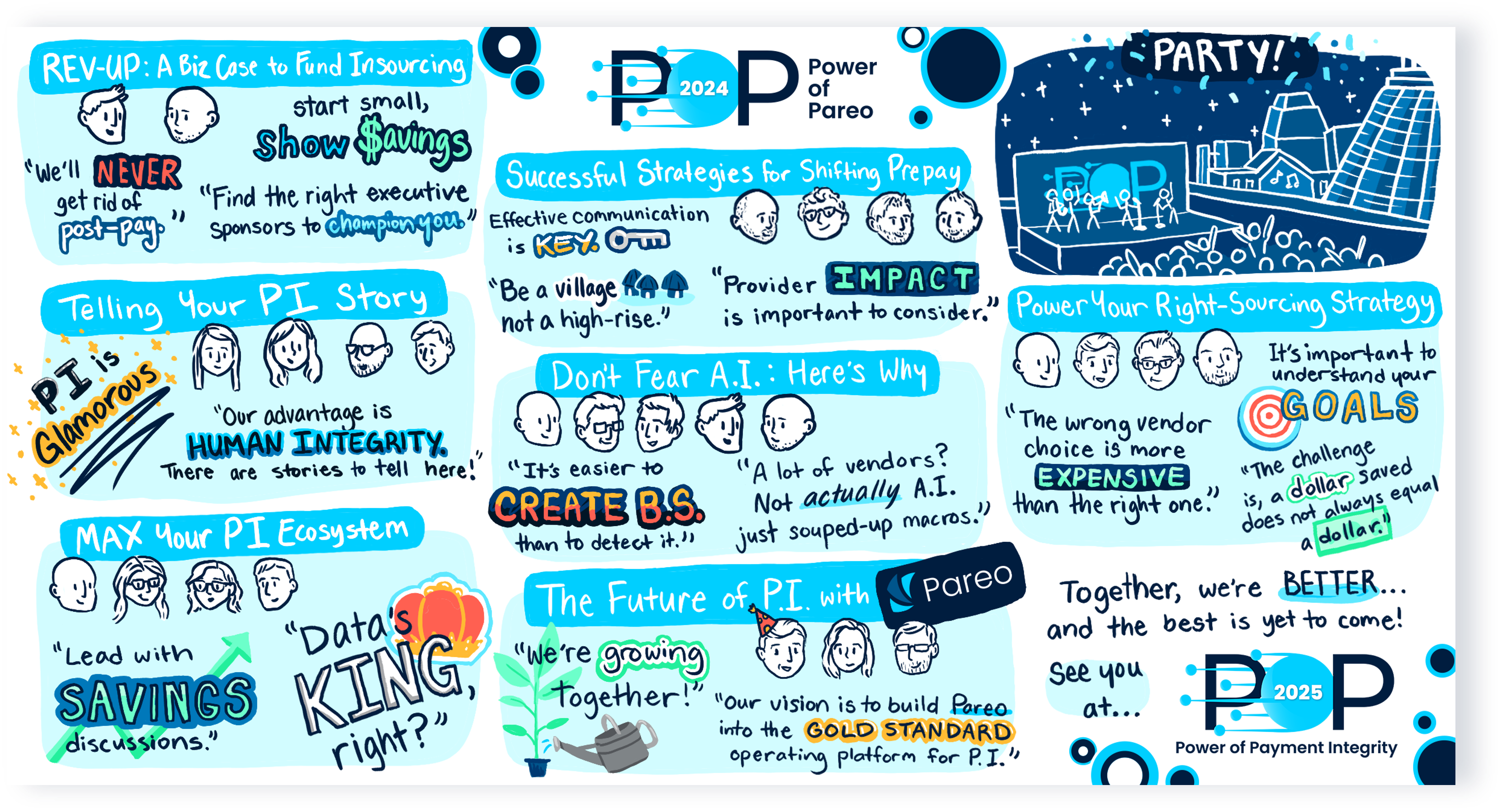

Payment integrity leaders from the country’s top health plans take time to collaborate at POP Conference 2024. They find strength in community, innovative ideas, and a focus on 4 primary industry drivers.

There is a growing sense that payment integrity is at an inflection point. With pressures around medical spend and administrative costs compounding, the leaders at POP Conference 2024 recognized opportunities for their payment accuracy operations are rising accordingly.

But what, exactly, does the industry need to meet that strategic opportunity?

Payment integrity leaders repeatedly shared that collaboration is what will drive the industry forward. Including:

- Collaboration internally within their own teams and others devoted to cost containment; with related internal stakeholders in Quality, Risk and Provider Relations; and with leadership like the CFO, COO and other executive champions

- Collaboration with providers

- Collaboration across the industry with other payment integrity leaders

In their wide-ranging conversations around this shared goal, four big trends kept coming to the forefront. The shift to prepay, leveraging data, insourcing strategies and – of course – the impact of A.I. on the industry were top themes, despite the surface differences between the health plans.

Let’s explore their takeaways from these trends — and how collaboration is advancing their progress.

1. Shift to Prepay

Shifting payment integrity’s focus from overpayment recovery in favor of prospective cost avoidance continues to be a goal. And there are indications of progress being made. While 85% of payment integrity remains post-pay, prepay is accelerating at 3x the pace.

And no wonder. Those organizations able to move mature post-pay analytics upstream increase savings while reducing administrative costs. Those prepay savings average $1.96 per member per year.

Those payment integrity offices with a record of success in this area point to the contributions of their partnerships. Acknowledging and mitigating provider impact is key. They surface education opportunities directly with providers to correct behaviors. And they equip provider relations teams with actionable insights.

For example, they detail the percentage of claims flagged for prepay review. Then, they share the true positive or findings rate, highlight problem areas, and provide explanations. The result is a more empowered and engaged partner. Deceptively simple? Maybe. But proven effective.

“Be a village. Not a high-rise.”

2. Making the Most of Data

Payment integrity is in a unique position to integrate data and distribute insights, which makes this function an ideal collaboration partner. As one panelist at the conference put it, “Data is the value prop of payment integrity.”

Timely business intelligence ensures payment integrity leaders get a seat at the health plan strategy table. With their access to and perspective on claims data, their insights can help leadership make informed decisions quickly.

This data also helps them add value to adjacent functions. For instance, educating providers on bad billing practices, communicating value to groups, and contributing information to provider contracting.

They are also using the data to “do more with less.” Looking for opportunities to streamline processes, focus on vendor and program performance, and better leverage existing expertise all cut administrative costs and add value to the bottom line.

“Our advantage is human integrity. There are stories here. Stories of overpaying — of fraud — that help us communicate value.”

Your “DIY” Strategy for Payment Integrity

Watch this free executive briefing to see how payment integrity leaders are driving more savings with less administrative spend in their PIOs.

3. Internalizing Audit Programs

The decision on whether to insource or outsource can be difficult. According to recent research, 50% of payers haven’t figured out their sourcing strategy. And, on average, only 20% of recoveries are driven by internal teams.

This limited progress makes sense. Insourced audit programs may yield lower recoveries compared to outsourced ones, especially at first. Payment integrity teams also will have to invest in technology and expertise. Finding specialized talent continues to be a barrier for many.

But the shift in favor of internal teams still holds appeal. Outsourcing is expensive. Average contingency rates are 15%, and actual rates are often higher. Though outsourcing is traditionally seen as a low-cost, low-risk approach, payment integrity teams are becoming more sensitive to the hidden costs of bringing on vendors. Those costs include IT expenses around data exchanges, personnel costs to manage vendors, and potential negative impacts on providers.

The right sourcing mix will vary by health plan. But – insourced or outsourced – payment integrity leaders are seeking greater accountability in their payment accuracy operations.

“Why do we keep paying vendors for the same dollars, the same edits, day in and day out, for 20 years?”

4. The Potential of A.I. for Payment Integrity

The evolution of artificial intelligence has dominated the dialogue across varied industries, and it featured heavily at POP Conference as well. According to industry research, 86% of healthcare leaders believe their organizations’ ability to effectively leverage tech, data and AI will define their success over the next five years. To that end, the discussions yielded three important near-term considerations.

First, payers should consider how upstream stakeholders are using A.I. On the claims billing revenue cycle side, A.I.-powered tools are getting better at upcoding prompts. Expert panelists from McKinsey noted its potential to put bad behaviors “on steroids.” They also cautioned that, currently, it’s easier for A.I. to create bad information than detect it.

Second, the best use case for A.I. in payment integrity today is tackling administrative work. By pulling together disparate information to speed up expert decision-making, A.I. tools can make the most of limited resources. For example, a bot gathering relevant policy, coding guidelines, provider history, chart elements, CMS guidance and more could surface high-potential claims for further research, instead of relying solely on auditor time and knowledge.

Finally, there was broad consensus that investments in A.I. that yield innovation value are still to come, perhaps as part of the 2025-2027 strategy. To prepare for the shift, many payers have or are setting up an A.I. office or governance committee with a two-pronged approach of upfront governance and downstream monitoring.

Taking a portfolio approach to A.I. investment offers greater value within the organization. And, again, there is potential to collaborate outside of the health plan walls as well, sharing emerging themes and common queries.

“A.I. is the biggest technological change since the cell phone and internet. We just have to figure out how to keep it from being really good or really bad.”

How to Evaluate Payment Integrity Solutions

Get the ultimate guide for health plans seeking technology, with the top 14 areas of evaluation to ensure a perfect fit for the organization’s goals.

The Best is Yet to Come

Many payment integrity leaders and their health plans are trying to resolve the same challenges. As a result, idea sharing and finding strength in numbers are particularly valuable. However, despite payment integrity’s growing strategic importance, they still operate in a niche. Meaning, the industry is still lacking options for leaders to truly connect with like-minded peers.

Given an environment of payment integrity focus and no sales pressure, transparent conversations around vendor-agnostic solutions can flourish. With that in mind, POP Conference is undergoing a significant shift in 2025.

In April 2025 the Power of Payment Integrity Conference will be held in Nashville to serve all innovative leaders with a platform to build their programs, tell their stories, execute their strategies, and promote strategic conversations — whether they use Pareo or not.

The best is yet to come for the industry, and these leaders are working together to ensure it works for all of them.

“I came home feeling even more energized and excited to be a Payment Integrity leader. I can’t wait until next year when we can celebrate how much we have accomplished being better together!”

Now’s the time for total payment integrity

See the ClarisHealth 360-degree solution for total payment integrity in action.